Personal vs Business Trip

Personal vs Business Trip

The University of Houston allows travelers to travel to their business destination one contiguous day before and one contiguous day after business days without providing additional documentation or explanation, these days will be counted as business days in calculating business versus personal days.

Travel days more than one day before a business purpose or more than one day after business day will require additional explanation and documentation such as an airfare price quotation plus lodging, meal and other expenses.

How is Travel Primarily for Business Purposes versus Travel Primarily for Personal Purposes calculated for domestic travel?

- The number of business days must exceed the number of personal days for travel to be considered to be primarily for business purposes.

- If the number of business days is equal to or less than the number of personal days, travel is considered to be primarily for personal purposes

Examples

- *Traveler spent 5 business days and 4 personal days – the travel is considered primarily for business.

- *Traveler spent 5 business days and 5 personal days – the travel is considered primarily for personal.

- *Traveler spent 4 business days and 5 personal days – the travel is considered primarily for personal.

What days count as business days for domestic travel?

- Days spent primarily on business activities

- Days where the traveler was required to be in that location on that date for a business purpose

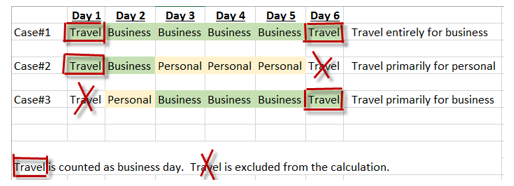

- Travel days to and from the business destination contiguous to a business day where the overnight stay is reasonable and necessary. Non-contiguous travel days are not included in the calculation.

Examples

*** Travel Day is given only when an overnight stay is necessary and reasonable.

Do travel days have to be immediately after the business activity for travel expenses to be eligible for reimbursement?

- No, so long as travel business days are equal to or greater than personal days.

- Travel days that are not contiguous to business days are not included in the calculation of travel days versus personal days. See page 1: What days count as business days for domestic travel?

What can be reimbursed for travel primarily for business purposes?

- Cost of transportation to and from the business destination, at lowest cost. Personal days cannot increase the cost of transportation. If travel occurs with personal days in between business days, only the cost of transportation directly back to Houston will be reimbursed (airfare, train, mileage)

- Actual Meals during business days and necessary travel days.

- Hotel costs for business days (note – hotel costs are associated with the night before; i.e., if the conference is all day Monday and ends in the late afternoon on Tuesday, in most cases hotel for Sunday and Monday would be reimbursable)

- Incidentals, tips, and other business expenses that are ordinary and necessary

- No costs will be reimbursed for travel days that are not contiguous to a business day, other than the cost of transportation directly back to Houston.

What can be reimbursed for travel primarily for personal purposes?

- Business expenses incurred during the trip that are directly related to the business. For example, a conference registration and hotel costs during the conference only

- Vacation after Business

Source: IRS Publication 463